- #Personal finance software online how to

- #Personal finance software online update

- #Personal finance software online free

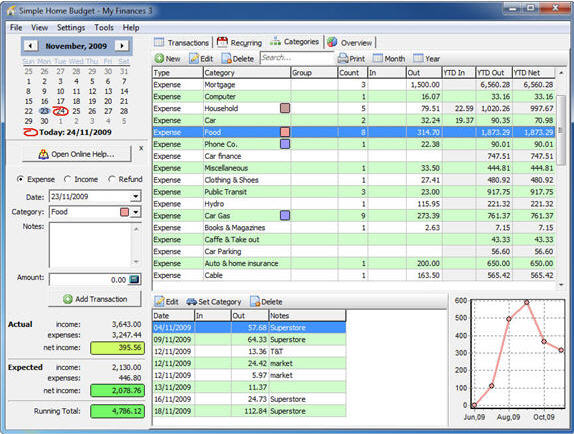

After the initial setup, you have all the information ready to go. You don’t have to spend hours every weekend updating your spreadsheet. Having all the data under a single system can save a lot of time. Because you don’t have to manually input the information, you can guarantee it’s error-free. You’ll get to view your savings account, checking account and retirement accounts at the same time. Having the information from different accounts complied together makes it easier to understand the big picture. Others might require you to input the information manually.

#Personal finance software online update

Some software will update your transactions automatically after the initial setup. It is often effortless to do directly from your banking app. Some personal finance software automatically gathers all this data for you when you create an account and link it with your other accounts. All regulated banks in the UK are obligated to let you share your details with authorised service providers, such as personal finance software.īecause of the data sharing, the software can collect information from your various accounts. Third-party software can collect information from other accounts through Open Banking. Inputting all the details manually to a spreadsheet can take a lot of time and effort. You might have many different accounts and credit cards. Let’s explore the most significant benefits: Compiling your financial situation The apps have a lot of useful functionality you just don’t get with a spreadsheet. Couldn’t you just track your spending with a good old pen and paper? Creating an Excel spreadsheet isn’t that difficult and could serve a similar purpose. You might be wondering if using software is worth it. What are the benefits of using personal finance software? We’ll highlight five products worth checking out later in this guide.

#Personal finance software online free

There are many different products available, including free and paid services. In essence, personal finance software is like having a personal secretary at your disposal, no matter where you are. Personal finance apps are available for your computer, tablet or smartphone.

For example, they can provide you with information on investments or direct you to different savings accounts.

#Personal finance software online how to

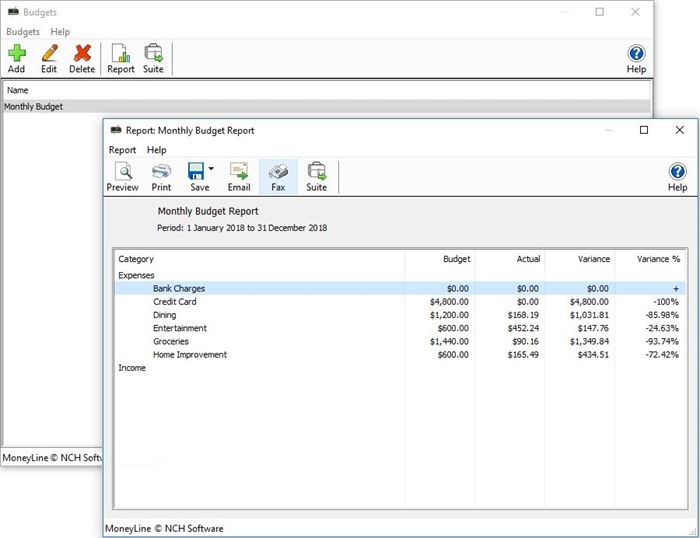

Some personal finance software can also provide tips on how to improve your finances. Software helps bring all these accounts together and give you a more comprehensive view of your financial situation. For example, you might have several savings and investment accounts, with different banks and service providers. Software makes it easier to track everything. Monitor your bank accounts, credit cards, loans and investments.But at its core, personal finance software tends to help you track your money and make smarter financial decisions. There are many options out there, and each has different functionalities. Personal finance software helps you with money management.

You’ll also find information on some of the best personal finance software out there. In this guide, we’ll look at what personal finance software is and how it could help.

Budgeting is a crucial part of financial freedom, and there are lots of different types of budgeting apps and programs available these days. You should prepare for retirement and understand your pension payments before they even start. Your financial situation can significantly change as you get older.

0 kommentar(er)

0 kommentar(er)